No, your policy doesn’t provide cover for any mechanical failure, or wear and tear to your vehicle or its parts.

Car insurance for young drivers

Car insurance for young drivers

You may have heard of ‘young driver insurance’. But rather than being a policy specifically for young drivers, it usually just refers to a standard policy being taken out by a driver under the age of 25.

Insurance for young drivers

Getting your car insurance with 1st Central comes with many benefits.

What is insurance for young drivers?

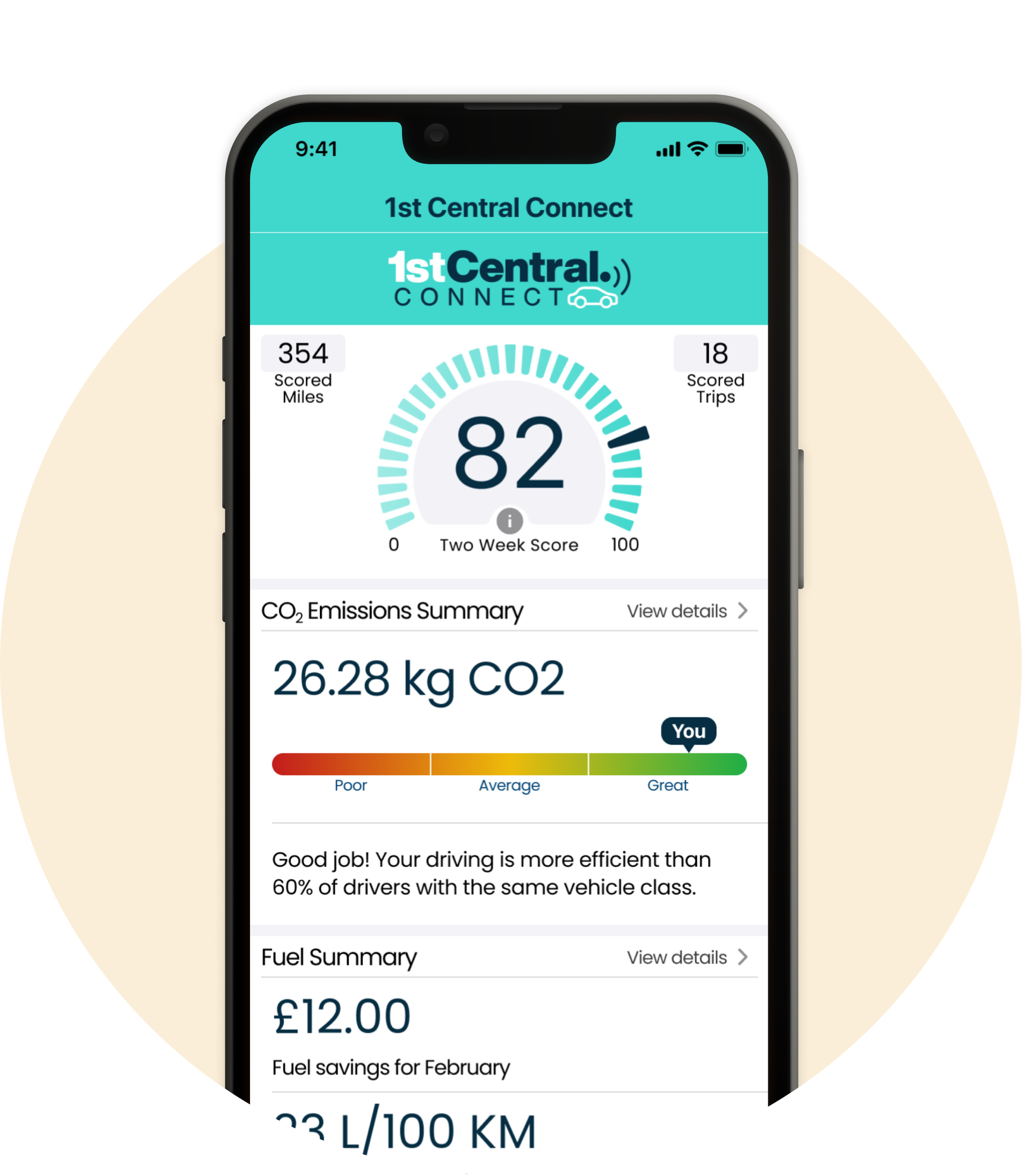

1st Central Connect

Another way young drivers could potentially save on their car insurance is to take out a telematics policy. A sensor can be installed into your car to monitor your driving. It will then score you based on multiple factors to determine how safe of a driver you are.

1st Central Connect is our telematics-based insurance policy which runs from a sensor and an app. It’s also a lot easier to install than a traditional black box insurance product, and it can help young drivers lower the cost of their insurance.

-

Journey feedback

-

Driving scores for your journeys

-

Crash detection

Factors that affect the cost of car insurance for young drivers

These are some of the factors that can impact the cost of your insurance.

The car you'll be driving

The make and model of your car can affect the cost of your insurance. If your first car is new or a luxury model, your insurance is likely to be higher.

Your mileage

The amount of time you spend on the road will impact your premium, with lower annual mileage potentially lowering your insurance costs. Providing accurate mileage is important, as it can affect your coverage and any claims you may need to make.

Second driver

Adding a more experienced driver to your policy can impact the price of your premium. However, any additional drivers need to be someone who actually drives the car, and the main driver should be the person who drives it most often.

Pass Plus qualification

This is not mandatory, but it can help to improve your driving skills and potentially lower your insurance costs.

Answers to important questions

Do you insure learner drivers?

Yes, we do.

We try to be competitive in the young and learner driver market and will insure learner drivers subject to normal underwriting rules.

What car insurance payment options do you offer?

If you're 18 or over, you have the option of paying in full or in instalments, subject to a creditworthiness assessment. It's more expensive to pay for your policy by monthly instalments instead of paying in full, because you're charged interest on a loan.

However, if you're 17 you'll need to pay in full as car finance is not an option for 17-year-olds, as you're not allowed to sign a credit agreement until the age of 18.

If you decide to pay by instalments, we offer two options: a direct debit from your bank or monthly recurring card payments from a debit or credit card.

When you purchase a policy for the first time and decide to pay monthly, you'll be required to pay a deposit on the day you purchase, in addition to your monthly instalments.

We accept the following cards:

Visa, Visa Electron, Mastercard, Maestro

Does my car insurance cover mechanical failure?

What does the 1st Central Connect app detect and measure?

The 1st Central Connect app detects and measures a number of things, including:

Phone usage while driving - Don't use your smartphone whilst driving or hand it to a passenger to use. This can affect your driving score as the app detects when your phone is being used while your car is being driven.

Speed - Your driving score will be affected if you go over the speed limit. Always keep an eye on your speed and be aware of what the speed limit is.

Braking - The app will detect any hard or fast braking you make. Allow yourself enough time to break gradually, so you have plenty of time to react.

Cornering - Quick or hard turns when taking a corner can affect your driving score. So always try to drive smoothly and precisely around corners.

Hard acceleration - Your driving score will be affected if you accelerate too quickly. Gentle acceleration is always best - it's safer and doesn't put a strain on your car's engine.